09/15/2023

Identity Theft Scam

Leader of Identity Theft Conspiracy That Stole Nearly 50 Vehicles Sentenced to 8.5 Years in Prison

A Haverhill man was sentenced [on September 08, 2023] in federal court in Boston for orchestrating schemes to use the stolen identities of United States citizens from Puerto Rico to fraudulently purchase vehicles and other merchandise and apply for and utilize bank accounts and credit cards.

Together, the co-conspirators fraudulently purchased at least 47 vehicles from dealerships in Massachusetts, Pennsylvania, New York and New Jersey – obtaining over $2 million in cars and other merchandise using the stolen identities.

READ FULL PRESS RELEASE

Together, the co-conspirators fraudulently purchased at least 47 vehicles from dealerships in Massachusetts, Pennsylvania, New York and New Jersey – obtaining over $2 million in cars and other merchandise using the stolen identities.

READ FULL PRESS RELEASE

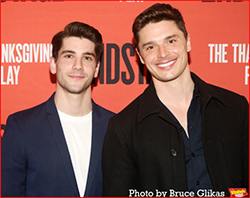

Dumb or dumber

Las Vegas rapper arrested after he allegedly ‘confessed’ to murder in music video

Kenjuan McDaniel, 25, was charged with murder in a 2021 shooting.LVMPD

Kenjuan McDaniel, 25, was charged with murder in a 2021 shooting.LVMPD

A Nevada rapper was arrested on murder charges after implicating himself in a music video by sharing details of the crime that only a killer could have known, police said.

Kenjuan McDaniel, 25, was picked up on August 29 after police said lyrics in one of his recently posted music videos included details about a 2021 murder that had not been publicly released, Las Vegas Metropolitan Police said.

READ FULL ARTICLE WITH LYRICS

Kenjuan McDaniel, 25, was picked up on August 29 after police said lyrics in one of his recently posted music videos included details about a 2021 murder that had not been publicly released, Las Vegas Metropolitan Police said.

READ FULL ARTICLE WITH LYRICS

09/14/2023

Elder Scams Vishing

How Fraudsters Target Retirees With ‘Vishing’ Scams.

“Vishing’ is a double-layered scam. It could start with a phone call stating “your grandson is in trouble and needs money.” Then the caller asks for money.

“Vishing, also known as voice phishing,” [...]“is a growing threat in the world of cybercrime specifically targeting the elderly population. By impersonating fake charities to con senior citizens into donating money, posing as a relative, or pretending to be trusted places like government agencies - the scam banks on the fact that the elderly are more keen to trust phone interactions. As a result, divulging credit card details, social security numbers, login credentials, or other valuable data is likely to be shared.”

“Vishing, also known as voice phishing,” [...]“is a growing threat in the world of cybercrime specifically targeting the elderly population. By impersonating fake charities to con senior citizens into donating money, posing as a relative, or pretending to be trusted places like government agencies - the scam banks on the fact that the elderly are more keen to trust phone interactions. As a result, divulging credit card details, social security numbers, login credentials, or other valuable data is likely to be shared.”

- Take the initiative to verify the caller's identity by going directly to the company’s organization’s website.

- Never share financial or personal information over the phone. Legitimate organizations will never request information like credit card details, social security numbers, or passwords.

- Don’t be afraid to question the legitimacy of unknown numbers and be weary of providing sensitive information over the phone without confirming the legitimacy of the caller.

- Caller ID can easily be spoofed, so don’t trust it alone to determine whether the call is legitimate. I recommend staying vigilant and being cautious about sharing sensitive information.

- Send any unrecognized phone caller to voicemail so you’re able to screen the call. Don’t forget to report suspicious calls or suspected fraudulent activity to FTC at ReportFraud.ftc.gov

Pay your student loans — not scammers

You’ve probably heard the news — federal student loan repayments are starting again in October. But scammers might try and tell you they can help you avoid repayment, lower your payments, or get your loans forgiven — for a price. Here’s how to spot and avoid these scams.

The most important thing to know is this: the best source of information on your federal student loans is Federal Student Aid. Also, you don’t need to pay to sign up for any programs to lower your payments or get forgiveness — it’s all free at StudentAid.gov/repay. And you can do it yourself. (Again: for free.)

Worried about repaying your loans? The calls and texts that offer "help" might be tempting. But before you act, know how to spot the scams:

As you get ready for repayment, here are some steps to take:

The most important thing to know is this: the best source of information on your federal student loans is Federal Student Aid. Also, you don’t need to pay to sign up for any programs to lower your payments or get forgiveness — it’s all free at StudentAid.gov/repay. And you can do it yourself. (Again: for free.)

Worried about repaying your loans? The calls and texts that offer "help" might be tempting. But before you act, know how to spot the scams:

- Don’t give away your FSA ID login information. Anyone who says they need it to help you is a scammer. If you share it, the scammer can cut off contact between you and your servicer — and even steal your identity.

- Don’t trust anyone who contacts you promising debt relief or loan forgiveness, even if they say they're affiliated with the Department of Education. Scammers try to look real, with official-looking names, seals, and logos. They promise special access to repayment plans or forgiveness options — which don’t exist. If you’re tempted, slow down, hang up, and log into your student loan account to review your options.

As you get ready for repayment, here are some steps to take:

- Update your contact information with FSA and your loan servicers. This way, you’ll get timely updates about your repayment plans.

- Enroll in a repayment plan. Use FSA’s Loan Simulator to estimate your monthly payments and compare your repayment options. If you’ve defaulted on your loans, look into the Fresh Start program.

09/13/2023

Elder Fraud

Trustworthy no more: family, friends are often culprits in elder fraud

Inage source: Article, Victim died in 2017,

Inage source: Article, Victim died in 2017,

Three out of four reported cases involve trusted individuals, say officials.

In 2011, 77-year-old Barbara McEneaney realized she needed more help. Suffering from Parkinson’s disease, the New Hampshire woman experienced memory loss and mobility issues. So, she added her brother, James Folley, as co-owner to her bank account. McEneaney had saved well, so she had more than enough in her life savings to pay the $4,000 monthly charges at an assisted living facility for a few decades.

Less than two years later, she was nearly penniless. The assisted living center facility agreed to reduce her monthly charge to avoid her having to leave. Authorities later found out who took McEneaney’s money—her brother and his wife….

READ MORE OF THIS STORY OF ABUSE

In 2011, 77-year-old Barbara McEneaney realized she needed more help. Suffering from Parkinson’s disease, the New Hampshire woman experienced memory loss and mobility issues. So, she added her brother, James Folley, as co-owner to her bank account. McEneaney had saved well, so she had more than enough in her life savings to pay the $4,000 monthly charges at an assisted living facility for a few decades.

Less than two years later, she was nearly penniless. The assisted living center facility agreed to reduce her monthly charge to avoid her having to leave. Authorities later found out who took McEneaney’s money—her brother and his wife….

READ MORE OF THIS STORY OF ABUSE

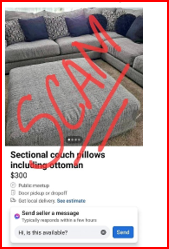

Scams

Job Scams

Scammers advertise jobs the same way honest employers do — online (in ads, on job sites, and social media), in newspapers, and sometimes on TV and radio. They promise you a job, but what they want is your money and your personal information.

Here are some examples of jobs scams and advice on how to avoid them.

Scammers advertise jobs the same way honest employers do — online (in ads, on job sites, and social media), in newspapers, and sometimes on TV and radio. They promise you a job, but what they want is your money and your personal information.

Here are some examples of jobs scams and advice on how to avoid them.

- Examples of Job Scams

- Work-from-home job scams

- Nanny, caregiver, and virtual personal assistant job scams

- Mystery shopper scams

- Job placement service scams

- Government and postal jobs scams

- How To Avoid a Job Scam

09/12/2023

Scams

All may not be lost for victims of computer scams who go on the offensive against banks and cards

When Willie Sutton, the notorious American bank robber, was asked why he stole from banks, his answer was very simple: “Because that’s where the money is.” Today scammers far outnumber bank robbers and, if they could ever be found, would likely include credit card companies along with banks for the same reason.

Banks and credit card companies are very much aware of these schemes. So, too, are law enforcement, federal and state regulatory agencies and the AARP, an association for older and retired people. They warn customers of scammers and many of their schemes on the net in articles and videos for that purpose.

Whatever is done or not done, no compensation will ultimately be offered. The bank or credit card company anticipates that the customer will give up and go away.

The customer should not go away. Compensation can very often be obtained if the bank or credit card company is confronted by a competent lawyer, one who is clearly prepared to file a suit and go to trial if necessary to subject the bank or credit card’s intransigence to public disclosure.

SOURCE

Banks and credit card companies are very much aware of these schemes. So, too, are law enforcement, federal and state regulatory agencies and the AARP, an association for older and retired people. They warn customers of scammers and many of their schemes on the net in articles and videos for that purpose.

Whatever is done or not done, no compensation will ultimately be offered. The bank or credit card company anticipates that the customer will give up and go away.

The customer should not go away. Compensation can very often be obtained if the bank or credit card company is confronted by a competent lawyer, one who is clearly prepared to file a suit and go to trial if necessary to subject the bank or credit card’s intransigence to public disclosure.

SOURCE

Debt Relief

BBB Warns of Debt Relief, Credit Repair Company Scams

Image source: Article

Image source: Article

People seeking help from companies promising to reduce or eliminate debt or fix their credit scores are getting duped, and often are left financially worse off, according to a new report.

Judy Dollison, president of the Better Business Bureau of Central Ohio, said the rise in student loan, medical and credit card debt has increased demand for such services. The problem, she said, is not all companies are legitimate.

"BBB has had more than 12,000 complaints and negative reviews combined about credit and debit assistance companies," Dollison reported. "That just shows you that this is a problem."

The Better Business Bureau advised using a credit report service such as AnnualCreditReport.com, and calling the debt holders yourself to attempt to negotiate a lower payment or interest rate.

Dollison pointed out sketchy debt relief, debt consolidation and credit repair companies offer quick and extensive financial fixes and use high-pressure tactics to get consumers to quickly pay upfront fees.

"What we find is, if it sounds too good to be true, it usually is," Dollison explained. "Credit and debit repair actually take months, if not years, to solve." ...

READ MORE FROM THE SOURCE

Judy Dollison, president of the Better Business Bureau of Central Ohio, said the rise in student loan, medical and credit card debt has increased demand for such services. The problem, she said, is not all companies are legitimate.

"BBB has had more than 12,000 complaints and negative reviews combined about credit and debit assistance companies," Dollison reported. "That just shows you that this is a problem."

The Better Business Bureau advised using a credit report service such as AnnualCreditReport.com, and calling the debt holders yourself to attempt to negotiate a lower payment or interest rate.

Dollison pointed out sketchy debt relief, debt consolidation and credit repair companies offer quick and extensive financial fixes and use high-pressure tactics to get consumers to quickly pay upfront fees.

"What we find is, if it sounds too good to be true, it usually is," Dollison explained. "Credit and debit repair actually take months, if not years, to solve." ...

READ MORE FROM THE SOURCE

09/11/2023

Elder Fraud

Protecting yourself from cybercrimes

Unfortunately, cybercrimes against seniors continue to be a big problem in the U.S. According to the FBI 2022 Elder Fraud Report, cybercrime cost Americans over age 60 more than $3 billion last year, a whopping 84 percent increase from 2021.

While anyone can be subject to cybercrimes, seniors are frequent targets because they tend to be more trusting and have more money than their younger counterparts. But there are a number of things you can do to protect yourself from online fraud, hacking and scams. Here are a few tips to get you started.

While anyone can be subject to cybercrimes, seniors are frequent targets because they tend to be more trusting and have more money than their younger counterparts. But there are a number of things you can do to protect yourself from online fraud, hacking and scams. Here are a few tips to get you started.

- Strengthen your passwords.

- Opt out of pop-ups.

- When in doubt, throw it out.

- Share with care.

- Verify websites.

- Have some back-up.

09/10/2023

Home Repair Fraud

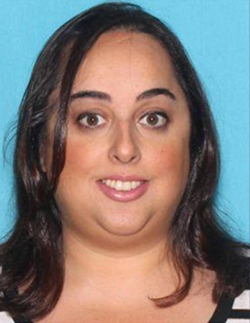

Police arrest woman for alleged home repair fraud

A woman was hired and paid for home repair work but was arrested for allegedly never completing the job.

Tupelo [Mississippi] police received a report of a home repair fraud back in August.

Investigators said the homeowner hired Stephanie Williford (pictured) for interior design work.

Williford allegedly did not complete all the work agreed upon in the transaction.

Officers arrested Williford and charged her with two counts of grand larceny and two counts of false pretense. Her bond has been set at $20,000.

SOURCE

Tupelo [Mississippi] police received a report of a home repair fraud back in August.

Investigators said the homeowner hired Stephanie Williford (pictured) for interior design work.

Williford allegedly did not complete all the work agreed upon in the transaction.

Officers arrested Williford and charged her with two counts of grand larceny and two counts of false pretense. Her bond has been set at $20,000.

SOURCE

Scam payback

Scammer Payback U-Tube Video Only

09/09/2023

FinCEN Scam Notice - Pig Butchering

Financial Crimes Information Network Issues Alert on Prevalent Virtual Currency Investment Scam Commonly Known as “Pig Butchering”

“Pig butchering” scams resemble the practice of fattening a hog before slaughter. Victims invest in supposedly legitimate virtual currency investment opportunities before they are conned out of their money.

Scammers refer to victims as “pigs,” and may leverage fictitious identities, the guise of potential relationships, and elaborate storylines to “fatten up” the victim into believing they are in trusted partnerships before they defraud the victims of their assets—the “butchering.”

These scams are largely perpetrated by criminal enterprises based in Southeast Asia who use victims of labor trafficking to conduct outreach to millions of unsuspecting individuals around the world.

READ MORE

Scammers refer to victims as “pigs,” and may leverage fictitious identities, the guise of potential relationships, and elaborate storylines to “fatten up” the victim into believing they are in trusted partnerships before they defraud the victims of their assets—the “butchering.”

These scams are largely perpetrated by criminal enterprises based in Southeast Asia who use victims of labor trafficking to conduct outreach to millions of unsuspecting individuals around the world.

READ MORE

09/07/2023

Elder Fraud

Investor swindles elderly woman out of her home. A judge returns it to her

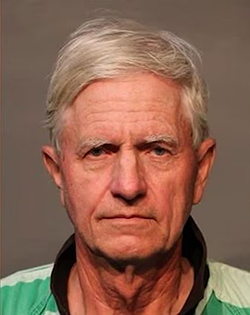

An 80-year-old woman has regained ownership of her Long Beach home following a civil trial where jurors found a real estate investor was guilty of elder abuse and fraud.

“It’s a big relief,” said Suzanne Yorganson after learning the home was once again hers. “I bought it in 1979 and I lived there off and on with my family and it means a lot to me.”

In addition, the jury decided that the real estate investor, 70-year-old Ken Lamphear, must pay $3 million in punitive damages to Yorganson, along with $2.5 million in compensation for economic damages, Yorganson’s attorney, Bill Chapman said.

The decision Tuesday [09/06/2023] comes after more than a yearlong legal battle where Yorganson’s attorneys argued Lamphear not only took advantage of her while she was in a vulnerable state following a stroke, but that Lamphear didn’t fulfill any of the promises he made, including paying Yorganson the agreed-upon $300,000.

READ THE WHOLE STORY

“It’s a big relief,” said Suzanne Yorganson after learning the home was once again hers. “I bought it in 1979 and I lived there off and on with my family and it means a lot to me.”

In addition, the jury decided that the real estate investor, 70-year-old Ken Lamphear, must pay $3 million in punitive damages to Yorganson, along with $2.5 million in compensation for economic damages, Yorganson’s attorney, Bill Chapman said.

The decision Tuesday [09/06/2023] comes after more than a yearlong legal battle where Yorganson’s attorneys argued Lamphear not only took advantage of her while she was in a vulnerable state following a stroke, but that Lamphear didn’t fulfill any of the promises he made, including paying Yorganson the agreed-upon $300,000.

READ THE WHOLE STORY

09/06/2023

Dark Web AI Fraud

Criminal enterprise flaunts AI in creepy 'fraud-for-hire' commercial meant for dark web

A criminologist recently unearthed a video of a multibillion-dollar, transnational criminal organization that has been stealing from the U.S. government since the pandemic and selling generative artificial intelligence tools to other criminals, an expert says

The 58-second clip, which was meant for the dark web, opens with a person – who goes by "Sanchez" – covered head to toe in black clothing and speaking behind a black skeleton mask with someone else who appears to be digging a grave behind him.

"Yes, I sell Chase bank accounts. Yes, I am one of the first people to sell fake bank accounts four years ago," the man who calls himself "Sanchez" said. "We started with my partner four years ago. Now we are about 30 people in one office."

READ THE FULL ARTICLE

The 58-second clip, which was meant for the dark web, opens with a person – who goes by "Sanchez" – covered head to toe in black clothing and speaking behind a black skeleton mask with someone else who appears to be digging a grave behind him.

"Yes, I sell Chase bank accounts. Yes, I am one of the first people to sell fake bank accounts four years ago," the man who calls himself "Sanchez" said. "We started with my partner four years ago. Now we are about 30 people in one office."

READ THE FULL ARTICLE

09/05/2023

Cybercrime

Protect Yourself from Cybercrimes

How Seniors Can Protect Themselves from Cybercrimes

Cybercrimes against seniors continue to be a big problem in the U.S. According to the FBI 2022 Elder Fraud Report, cybercrime cost Americans over age 60 more than $3 billion last year, a whopping 84 percent increase from 2021.

While anyone can be subject to cybercrimes, seniors are frequent targets because they tend to be more trusting and have more money than their younger counterparts. But there are a number of things you can do to protect yourself from online fraud, hacking and scams. Here are a few tips to get you started:

Cybercrimes against seniors continue to be a big problem in the U.S. According to the FBI 2022 Elder Fraud Report, cybercrime cost Americans over age 60 more than $3 billion last year, a whopping 84 percent increase from 2021.

While anyone can be subject to cybercrimes, seniors are frequent targets because they tend to be more trusting and have more money than their younger counterparts. But there are a number of things you can do to protect yourself from online fraud, hacking and scams. Here are a few tips to get you started:

- Strengthen your passwords.

- On your smartphone or tablet, be sure to set up a four or six-digit PIN to protect your device. A strong password should contain at least 12 characters and include numbers and a special character.

- Opt out of pop-ups. To protect yourself from computer viruses and other forms of malware, make it a habit to avoid any pop-up style message when you’re on the web.

- When in doubt, throw it out. Sometimes online hackers will send you an email or text message and pretend to be someone they’re not to convince you to share valuable information with them, such as your Social Security Number, address or credit card information.

- If you receive a message from an unknown sender, do not respond or click on any links or attachments.

- Share with care. There is such a thing as oversharing, and it definitely applies to online profiles. On social media platforms like Facebook, Instagram and Twitter, online hackers can easily gather information about you from what you post, like where you live.

- Ensure that your privacy settings are up to date.

- Verify websites. Before you shop or access your bank online, double check the validity of the website you’re using.

- Have some back-up.

09/04/2023

Elder Fraud

How to prevent caregiver fraud

Family caregivers might need to hire assistance while caring for a loved one. Finding in-home care can be a complicated journey especially when you consider the older adult’s safety. AARP recently released an article that highlighted tips for protecting older adults from caregiver fraud.

- Secure valuables, cash, and cards

- Be present.

- Use technology.

- Monitor transactions.

- Watch for warning signs.

Elder Abuse

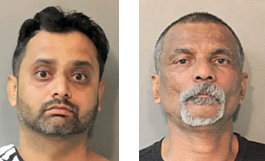

Police arrest two for string of pickpocket thefts in Burbank

Los Angeles residents Oscar Perdomo Flores, 48, and Maria Perdomo, 56, were arrested on Tuesday on suspicion of grand theft, fraud, and elder abuse after they were connected to a string of thefts targeting elderly people at stores.

"The suspects targeted elderly retail shoppers, stealing their wallets in distraction style thefts," Burbank police said in a statement earlier in August, when they asked the public for help in identifying the thieves. "Detectives have noted a common pattern among thieves who are targeting shoppers carrying purses or bags while shopping at local retailers. In these instances, multiple suspects will work together to distract the victim by talking to them or brushing up against them while pretending to shop for goods."

It's then that the other suspects reach into the bag or unattended purse and take the victim's wallet, police said.

READ MORE

"The suspects targeted elderly retail shoppers, stealing their wallets in distraction style thefts," Burbank police said in a statement earlier in August, when they asked the public for help in identifying the thieves. "Detectives have noted a common pattern among thieves who are targeting shoppers carrying purses or bags while shopping at local retailers. In these instances, multiple suspects will work together to distract the victim by talking to them or brushing up against them while pretending to shop for goods."

It's then that the other suspects reach into the bag or unattended purse and take the victim's wallet, police said.

READ MORE

09/03/2023

Deepfake Scams - AI

Deepfake Scams Are Becoming So Sophisticated, They Could Start Impersonating Your Boss and Coworkers

Cybercriminals exploit AI voice and video tech for convincing scams, with concerns growing on their potential to mimic real-life executives.

Cybercriminals are leveraging AI-driven voice simulation and deepfake video technology to deceive individuals and organizations, Bloomberg reported. In a recent incident, a CEO transferred $249,000 in funds after receiving a call that sounded like it came from a trusted source, only to discover it was generated by AI.

READ MORE

Cybercriminals are leveraging AI-driven voice simulation and deepfake video technology to deceive individuals and organizations, Bloomberg reported. In a recent incident, a CEO transferred $249,000 in funds after receiving a call that sounded like it came from a trusted source, only to discover it was generated by AI.

READ MORE

Elder Scam - Investment

See Your Name in Lights! Latest Scam Makes Elder Investors Think They’ll Be Hollywood Producers.

Photo from article

Photo from article

For countless older Americans, the idea of being on the silver screen has some magic. Even in the streaming age, the thought of being a Hollywood producer has some appeal.

Fraud against older Americans in investment schemes, reports the FBI, accounted for nearly one-third of the $3.1 billion in elder financial exploitation nationwide last year, up from less than 10% three years ago. Reported losses from elder investment scams have jumped tenfold in the past three years, to nearly $1 billion in 2022.

READ MORE

Fraud against older Americans in investment schemes, reports the FBI, accounted for nearly one-third of the $3.1 billion in elder financial exploitation nationwide last year, up from less than 10% three years ago. Reported losses from elder investment scams have jumped tenfold in the past three years, to nearly $1 billion in 2022.

READ MORE

09/01/2023

Elder Fraud

Indictments by a federal grand jury for charges of conspiracy to commit wire fraud exceeding $1.5 million involving US elders.

Three residents of Panama have been indicted by a federal grand jury in Pittsburgh, PA, on charges of conspiracy to commit wire fraud and conspiracy to commit money laundering.

The charges stem from the Department of Justice’s wide-ranging efforts to protect older adults from fraud and financial exploitation.

Stefano Zanetti, a 41-year-old citizen of Canada; Samuel David Ferrer Avila, a 22-year-old citizen of Venezuela; and Cesar Javier Chourio Morante, a 27-year-old citizen of Venezuela and Colombia, were named as defendants in separate two-count Indictments.

“Our office is committed to protecting elderly and other vulnerable victims from fraud schemes targeting residents of Western Pennsylvania,” said U.S. Attorney Olshan. “This case demonstrates that we will use all available tools to identify and hold accountable those who steal from seniors, and we will work with our domestic and international partners to seek justice even when the evidence leads to perpetrators operating outside the United States. We encourage people to make use of the Department of Justice’s online resources to learn about these common fraud schemes and avoid falling prey to them.”

“International financial fraud investigations are at the core of HSI’s mission. As such, we take great pride in protecting our seniors who are among our most vulnerable and valuable citizens,” said Special Agent in Charge of HSI Philadelphia William S. Walker. “HSI will utilize every resource, both here and abroad, to ensure that the American public is kept safe from those that hide in foreign countries while attempting to defraud our citizens.”

As alleged in the Indictments, the defendants orchestrated and executed a sophisticated nationwide scheme to defraud that targeted the elderly and caused losses exceeding $1,500,000raud and conspiracy to commit money laundering involving US elders.

READ THE FULL STORY

The charges stem from the Department of Justice’s wide-ranging efforts to protect older adults from fraud and financial exploitation.

Stefano Zanetti, a 41-year-old citizen of Canada; Samuel David Ferrer Avila, a 22-year-old citizen of Venezuela; and Cesar Javier Chourio Morante, a 27-year-old citizen of Venezuela and Colombia, were named as defendants in separate two-count Indictments.

“Our office is committed to protecting elderly and other vulnerable victims from fraud schemes targeting residents of Western Pennsylvania,” said U.S. Attorney Olshan. “This case demonstrates that we will use all available tools to identify and hold accountable those who steal from seniors, and we will work with our domestic and international partners to seek justice even when the evidence leads to perpetrators operating outside the United States. We encourage people to make use of the Department of Justice’s online resources to learn about these common fraud schemes and avoid falling prey to them.”

“International financial fraud investigations are at the core of HSI’s mission. As such, we take great pride in protecting our seniors who are among our most vulnerable and valuable citizens,” said Special Agent in Charge of HSI Philadelphia William S. Walker. “HSI will utilize every resource, both here and abroad, to ensure that the American public is kept safe from those that hide in foreign countries while attempting to defraud our citizens.”

As alleged in the Indictments, the defendants orchestrated and executed a sophisticated nationwide scheme to defraud that targeted the elderly and caused losses exceeding $1,500,000raud and conspiracy to commit money laundering involving US elders.

READ THE FULL STORY

Weather related scams

Have you, or do you know someone who was affected by Hurricane Idalia?

Protect yourself against disaster-related scams.

Figuring out the full extent of Hurricane Idalia’s damage could take weeks or even months. But we already know that scammers will follow the path of the storm and try to take advantage of people doing their best to recover. While storms are unpredictable, there are ways to spot the tactics these scammers use — even if they change some of the details — so, read on.

As you focus on cleaning up, rebuilding, and getting back on track, learn more about disaster recovery scams. It’ll help you protect yourself and others affected by Hurricane Idalia. Here are a few ways to get started:

Figuring out the full extent of Hurricane Idalia’s damage could take weeks or even months. But we already know that scammers will follow the path of the storm and try to take advantage of people doing their best to recover. While storms are unpredictable, there are ways to spot the tactics these scammers use — even if they change some of the details — so, read on.

As you focus on cleaning up, rebuilding, and getting back on track, learn more about disaster recovery scams. It’ll help you protect yourself and others affected by Hurricane Idalia. Here are a few ways to get started:

- Follow the latest official updates on Hurricane Idalia at usa.gov/hurricane-idalia.

- Know scammers impersonate government officials, safety inspectors, utility workers, and others in the aftermath of a disaster. They might ask for money or personal information like your Social Security or account numbers. Don’t pay; and remember that nobody legit will contact you unexpectedly to ask for your Social Security, bank account, or credit card number.

- Never pay for government assistance. Anyone who asks you for money to get a FEMA application or help is a scammer. Walk away and report them. To get alerts and more information, download the FEMA Mobile App.

- Spot scams by how they ask you to pay. Scammers will often demand you pay in a way they can get your money quickly — by wiring money, putting money on a gift card, sending cryptocurrency, using a payment app, or sending cash. If someone you don’t know says you have to pay that way, it’s a scam.

- Share what you know to help others stay alert to disaster-related scams you’re familiar with. Talk to friends and family and encourage them to learn more. Share this blog and other resources at ftc.gov/WeatherEmergencies with your social media followers.

08/31/2023

Financial Fraud

More Than 30% of Americans Have Been Victims of These 7 Financial Fraud Schemes: Here’s how To Protect Yourself

Have you ever lost money due to financial fraud? In August 2023, GO BankingRates surveyed 1,141 Americans to find out if respondents had been the victims of financial fraud. Those surveyed were given several options to show which types of financial fraud they faced.

Here's how the seven common forms of financial fraud have impacted Americans and tips for how to protect yourself.

Which Types of Financial Fraud Have Americans Experienced?

From highest to lowest percentage, Americans surveyed who have been victims of financial fraud said they have experienced the following schemes.

Here's how the seven common forms of financial fraud have impacted Americans and tips for how to protect yourself.

Which Types of Financial Fraud Have Americans Experienced?

From highest to lowest percentage, Americans surveyed who have been victims of financial fraud said they have experienced the following schemes.

- Consumer fraud: 39%

- Check fraud: 38%

- Mail fraud: 22%

- Business fraud: 17%

- Investment fraud: 14%

- Charity and disaster fraud: 6%

- Elder fraud: 5%

- How Can You Protect Yourself From Financial Fraud Schemes?

- Be Skeptical

- Don’t Give Out Your Personal or Financial Information

- Don’t Feel Pressured To Act Immediately

- Conduct Due Diligence

- Report It

Elder Fraud

Nigerian National Sentenced to Prison for International Scheme That Defrauded Elderly U.S. Victims

A dual U.K.-Nigerian national who was extradited to the United States from the United Kingdom was sentenced to 90 months in prison for his role in a transnational inheritance fraud scheme. With today’s sentencing, all three defendants who were extradited from the United Kingdom in connection with this matter have been sentenced.

According to court documents, Iheanyichukwu Jonathan Abraham, 44, was part of a group of fraudsters that sent personalized letters to elderly victims in the United States, falsely claiming that the sender was a representative of a bank in Spain and that the recipient was entitled to receive a multi-million-dollar inheritance left for the recipient by a family member who had died years before in Portugal. Victims were told that before they could receive their purported inheritance, they were required to send money for delivery fees and taxes and were instructed to make other payments. Victims sent money to the defendants through a complex web of U.S.-based former victims. Abraham and his co-conspirators also convinced former victims to receive money from new victims and then forward the fraud proceeds to others.

The other two defendants who were extradited from the United Kingdom also received prison sentences. On June 21, the Honorable Kathleen M. Williams sentenced Emmanuel Samuel to 82 months in prison, and on July 25, Judge Williams sentenced Jerry Chucks Ozor to 87 months in prison for their roles in the scheme. Two other co-defendants, who were extradited to the United States from Spain, have also pleaded guilty and are scheduled to be sentenced in October and November. ...

READ MORE

According to court documents, Iheanyichukwu Jonathan Abraham, 44, was part of a group of fraudsters that sent personalized letters to elderly victims in the United States, falsely claiming that the sender was a representative of a bank in Spain and that the recipient was entitled to receive a multi-million-dollar inheritance left for the recipient by a family member who had died years before in Portugal. Victims were told that before they could receive their purported inheritance, they were required to send money for delivery fees and taxes and were instructed to make other payments. Victims sent money to the defendants through a complex web of U.S.-based former victims. Abraham and his co-conspirators also convinced former victims to receive money from new victims and then forward the fraud proceeds to others.

The other two defendants who were extradited from the United Kingdom also received prison sentences. On June 21, the Honorable Kathleen M. Williams sentenced Emmanuel Samuel to 82 months in prison, and on July 25, Judge Williams sentenced Jerry Chucks Ozor to 87 months in prison for their roles in the scheme. Two other co-defendants, who were extradited to the United States from Spain, have also pleaded guilty and are scheduled to be sentenced in October and November. ...

READ MORE

08/30/2023

Fraud

Scammer sentenced to 2 years for making fake accounts and using stolen credit cards to buy football game tickets

COLLEGE STATION, Texas – A 48-year-old California man was sentenced to two years in prison after pleading guilty to a nationwide ticket scam that included a Texas A&M football game, the United States Department of Justice said.

U.S. Attorney Alamdar S. Hamdani said Derrick Langford admitted he used emails to obtain stolen credit card information from victims across the United States. He used that data and false identities to buy tickets for sporting events, concerts, and other entertainment venues across the country. He then re-sold the tickets on resale sites like Ticket Liquidator, the DOJ said.

As the scheme continued, investigators said Langford received stolen credit card information and personal identifying information of more than 75 victims in one of his email accounts....

READ THE FULL STORY

U.S. Attorney Alamdar S. Hamdani said Derrick Langford admitted he used emails to obtain stolen credit card information from victims across the United States. He used that data and false identities to buy tickets for sporting events, concerts, and other entertainment venues across the country. He then re-sold the tickets on resale sites like Ticket Liquidator, the DOJ said.

As the scheme continued, investigators said Langford received stolen credit card information and personal identifying information of more than 75 victims in one of his email accounts....

READ THE FULL STORY

Elder Fraud

Tips to avoid financial scams targeting the elderly

Recognizing common signs of a scam could help you avoid one.

Senior citizens are often the targets of these scams because they usually have assets, regular income and may be especially vulnerable due to isolation, cognitive decline, physical disability, health problems or bereavement.

Bankers are often the first to recognize signs of fraud or financial scams. They are trained to ask customers pointed questions when they suspect a case of elder financial abuse.

A change in banking patterns is one of the biggest red flags of a money scam. Bank tellers may ask specific questions when a customer suddenly makes a large cash withdrawal or wire transfer.

Unlike large check deposits, banks cannot put a hold on cash transactions. However, they can talk with customers to help them avoid becoming a victim.

To protect yourself, the Federal Trade Commission recommends resisting the pressure to act immediately.

“Always get a second opinion and check on it first before you send any money,” Nofziger said.

SOURCE

Senior citizens are often the targets of these scams because they usually have assets, regular income and may be especially vulnerable due to isolation, cognitive decline, physical disability, health problems or bereavement.

Bankers are often the first to recognize signs of fraud or financial scams. They are trained to ask customers pointed questions when they suspect a case of elder financial abuse.

A change in banking patterns is one of the biggest red flags of a money scam. Bank tellers may ask specific questions when a customer suddenly makes a large cash withdrawal or wire transfer.

Unlike large check deposits, banks cannot put a hold on cash transactions. However, they can talk with customers to help them avoid becoming a victim.

To protect yourself, the Federal Trade Commission recommends resisting the pressure to act immediately.

“Always get a second opinion and check on it first before you send any money,” Nofziger said.

SOURCE

08/29/2023

Elder Fraud

Contractor indicted on multiple fraud and theft charges for uncompleted projects

David A. Smith

David A. Smith

A grand jury has indicted a Walker County, Alabama contractor on 27 counts including financial exploitation of the elderly, theft of property, and home repair fraud.

David Alan Smith is accused of taking thousands of dollars for home projects and never completing them. Smith was arrested over the weekend and booked into the Walker County Jail where he is being held on a $270,000 cash bond.

READ MORE

David Alan Smith is accused of taking thousands of dollars for home projects and never completing them. Smith was arrested over the weekend and booked into the Walker County Jail where he is being held on a $270,000 cash bond.

READ MORE

08/27/2023

Elder Fraud

Scammers target Santa Clara County seniors

‘It is devastating’: Scammers target Santa Clara County (CA) seniors.

Sharon Sweeney was driving back from Home Depot when she received a call from an unknown number that would eventually end in costly consequences.

The caller introduced himself as Robert. He was the first of multiple people Sweeney, 77, talked to that day who posed as government agents. They created a collection of falsified documents and claims to scare her, Sweeney said, and even convinced her to sign a fake nondisclosure agreement to steer her away from telling any family, friends, or the authorities. The scammers had her on the line for hours.

Under their direction, Sweeney withdrew $20,000 from her bank account that she sent to the scammers via Bitcoin, digital currency that is difficult to track—her money gone forever.

“It (was) mind control,” Sweeney told San José Spotlight. “It leaves you feeling terribly vulnerable (and) constantly asking questions of yourself. Why didn’t I see the red flags?”

Cherie Bourlard, deputy district attorney for Santa Clara County, said older adults are targeted by scammers because they might have significant savings, valuable possessions or a lot of equity in their homes. She said they are also more prone to scams since they may not be as readily tech-savvy, are more trusting or may have physical or cognitive impairment.

“Financial elder abuse is hideous, because when elders are targeted, they are less resilient to recover financially,” Bourlard told San José Spotlight. “It is devastating because it occurs in their golden years.”

READ MORE

Sharon Sweeney was driving back from Home Depot when she received a call from an unknown number that would eventually end in costly consequences.

The caller introduced himself as Robert. He was the first of multiple people Sweeney, 77, talked to that day who posed as government agents. They created a collection of falsified documents and claims to scare her, Sweeney said, and even convinced her to sign a fake nondisclosure agreement to steer her away from telling any family, friends, or the authorities. The scammers had her on the line for hours.

Under their direction, Sweeney withdrew $20,000 from her bank account that she sent to the scammers via Bitcoin, digital currency that is difficult to track—her money gone forever.

“It (was) mind control,” Sweeney told San José Spotlight. “It leaves you feeling terribly vulnerable (and) constantly asking questions of yourself. Why didn’t I see the red flags?”

Cherie Bourlard, deputy district attorney for Santa Clara County, said older adults are targeted by scammers because they might have significant savings, valuable possessions or a lot of equity in their homes. She said they are also more prone to scams since they may not be as readily tech-savvy, are more trusting or may have physical or cognitive impairment.

“Financial elder abuse is hideous, because when elders are targeted, they are less resilient to recover financially,” Bourlard told San José Spotlight. “It is devastating because it occurs in their golden years.”

READ MORE

Dumb crook

Home invasion suspect drinks gasoline as police confront him.

Image Source: Article

Image Source: Article

A man police said was caught in the act of a home invasion began drinking gasoline when confronted by Seattle Police officers.

Seattle Police said the 40-year-old holding a wooden stick entered a residence last week while a 17-year-old female was at home. The girl's father called the police.

READ THE FULL STORY

Seattle Police said the 40-year-old holding a wooden stick entered a residence last week while a 17-year-old female was at home. The girl's father called the police.

READ THE FULL STORY

08/26/2023

Romance Scams Crypto

Romance Scammers Are Wooing Victims into Bogus Crypto Schemes

Getty Images/AARP Article

Getty Images/AARP Article

Are you hoping for true love? And more money than you ever imagined?

Who isn’t?

That’s why an unconscionable cadre of criminals dangle these twin temptations — the promise of romance and vast wealth — in what can be an emotionally and financially devastating double-barreled scam. The deception starts out as romance fraud and transforms into a cryptocurrency investment fraud in which victims have lost millions of dollars.

READ MORE

Who isn’t?

That’s why an unconscionable cadre of criminals dangle these twin temptations — the promise of romance and vast wealth — in what can be an emotionally and financially devastating double-barreled scam. The deception starts out as romance fraud and transforms into a cryptocurrency investment fraud in which victims have lost millions of dollars.

READ MORE

08/25/2023

Elder Scams

Jury finds 80-year-old veteran not guilty of trying to smuggle meth through DFW Airport

A jury has found 80-year-old Vietnam veteran Roy Payne not guilty of trying to smuggle drugs through DFW Airport earlier this year. Payne was acquitted despite the fact that he had seven pounds of methamphetamine hidden in his luggage while going through customs.

Federal prosecutors charged him even though he was actually a victim of a financial scam that sent him to Mexico thinking he had won an international lottery.

He was given a bag with meth hidden inside the bag and was told it was bank records that he needed to take back and pick up his winnings.

"There's a lot of people who come out and scam anyone and everyone. But it's our elderly who fall for this kind of stuff. But the government decided...instead of being a victim, they try him like he's some kind of criminal. Unfortunately, this had to go through the court."

SOURCE

Federal prosecutors charged him even though he was actually a victim of a financial scam that sent him to Mexico thinking he had won an international lottery.

He was given a bag with meth hidden inside the bag and was told it was bank records that he needed to take back and pick up his winnings.

"There's a lot of people who come out and scam anyone and everyone. But it's our elderly who fall for this kind of stuff. But the government decided...instead of being a victim, they try him like he's some kind of criminal. Unfortunately, this had to go through the court."

SOURCE

08/24/2023

Fraud Prevention: AARP

Scams the IRS Wants you to Know About

Criminals use a lot of different tactics to steal money from consumers, and one of those tactics is the promise of "free money". This summer the Internal Revenue Service (IRS) is warning taxpayers to be on the lookout for several scams that try to mislead people into believing the IRS owes them.

More from the AARP Fraud Watch Network

Learn How to Prevent IRS Impostor Scams.

Knowledge gives you power over scams. The AARP Fraud Watch Network equips you with reliable, up-to-date insights and connects you to our free fraud helpline so you can better protect yourself and your loved ones. We also advocate at the state, federal and local levels to enact policy changes that protect consumers and enforce laws.

And one more thing…

We (AARP) launched AARP VOA ReST, a free program that provides emotional support for people affected by a scam or fraud. ReST sessions are online, hour-long, confidential small groups led by trained peer facilitators. Experiencing a scam can be devastating, but it doesn't have to define you. Interested? Visit www.aarp.org/fraudsupport to learn more.

When it comes to fraud, vigilance is our number one weapon. You have the power to protect yourself and your loved ones from scams. Please share this alert with friends and family and visit the Fraud Watch Network for more information.

More from the AARP Fraud Watch Network

Learn How to Prevent IRS Impostor Scams.

- Learn More About Tax ID Scams.

- Do you think you have been targeted or have fallen victim to a scam? Contact the AARP Fraud Watch Network Helpline. Call 877-908-3360.

- You may receive a cardboard envelope from a delivery service. The enclosed letter includes the IRS masthead and the wording that the notice is "in relation to your unclaimed refund."

- The fake letter contains false contact details and asks for personal and financial information, such as a detailed photo of your driver's license.

- You might also receive an email reminding you to claim your Employee Retention Credit or your "stimulus."

- These emails often lead to a company that offers to search for unclaimed funds if you pay a sizable upfront fee.

- The mail scheme is an attempt to obtain sensitive personal information such as a Social Security number, date of birth, credit card or banking account numbers or driver's license.

- Recent reports indicate that driver's licenses are among the hottest commodities for criminals on the dark web.

- The IRS shared that the scam letter contains several grammatical and punctuation errors—which are often clear indicators of a scam.

- The ERC program and stimulus funds were part of the COVID-19 economic response and haven't been renewed.

- Ignore any unsolicited email, social media post or text claiming to be from the IRS (the IRS has stated that it won't contact you via these methods).

- Beware of anyone who claims you are owed money by the IRS who hasn't actually reviewed your taxes, and never pay an upfront fee to someone who says they can get your money back.

- Consult with a trusted tax professional whenever you have a question on whether you are eligible for any IRS program

Knowledge gives you power over scams. The AARP Fraud Watch Network equips you with reliable, up-to-date insights and connects you to our free fraud helpline so you can better protect yourself and your loved ones. We also advocate at the state, federal and local levels to enact policy changes that protect consumers and enforce laws.

And one more thing…

We (AARP) launched AARP VOA ReST, a free program that provides emotional support for people affected by a scam or fraud. ReST sessions are online, hour-long, confidential small groups led by trained peer facilitators. Experiencing a scam can be devastating, but it doesn't have to define you. Interested? Visit www.aarp.org/fraudsupport to learn more.

When it comes to fraud, vigilance is our number one weapon. You have the power to protect yourself and your loved ones from scams. Please share this alert with friends and family and visit the Fraud Watch Network for more information.

08/22/2023

Scam victim arrested

Scam victim tricked into stealing $200,000 for scammers, police say.

DES MOINES, Iowa (KCCI) - Police say an Iowa man who once lost thousands to a phone scam thought he was being vigilant, but he was tricked again, this time into working for the scammers.

Loren Esse is facing charges for his alleged participation in a money laundering scheme. Police say he was tricked into working for scammers, who convinced him they were a government agency investigating cybercrime.

“He started out in this case as a victim. But as he continued on, moving this money through these accounts and putting the cash into bitcoin and sending it on, what we realized was that he’s actually helping them facilitate this crime unknowingly,” said Des Moines Police Department Sgt. Paul Parizek.

Loren Esse is facing charges for his alleged participation in a money laundering scheme. Police say he was tricked into working for scammers, who convinced him they were a government agency investigating cybercrime.

SOURCE

DES MOINES, Iowa (KCCI) - Police say an Iowa man who once lost thousands to a phone scam thought he was being vigilant, but he was tricked again, this time into working for the scammers.

Loren Esse is facing charges for his alleged participation in a money laundering scheme. Police say he was tricked into working for scammers, who convinced him they were a government agency investigating cybercrime.

“He started out in this case as a victim. But as he continued on, moving this money through these accounts and putting the cash into bitcoin and sending it on, what we realized was that he’s actually helping them facilitate this crime unknowingly,” said Des Moines Police Department Sgt. Paul Parizek.

Loren Esse is facing charges for his alleged participation in a money laundering scheme. Police say he was tricked into working for scammers, who convinced him they were a government agency investigating cybercrime.

SOURCE

08/19/2023

Romance Fraud

Columbus man sentenced to 5 years in prison for laundering more than $2 million from online romance fraud scams

Maximus Okwudili Adiele, 49, of Columbus, was born in Nigeria and immigrated to the United States in 2010. He became a naturalized citizen in 2015.

According to court documents, from January 2017 until 2020, Adiele participated in a money laundering conspiracy, laundering $2.3 million for online romance fraud scammers into 12 different bank accounts that he controlled.

Adiele used his international car dealing business to conduct financial and wire transactions to individuals in Nigeria.

The conspiracy involved unidentified perpetrators who fabricated online relationships with men and women throughout the United States to manipulate the victims into sending money to one of Adiele’s bank accounts. Many of the victims of the scam were elderly individuals who lost their life savings. In total, Adiele laundered the money from at least 17 victims.

SOURCE

According to court documents, from January 2017 until 2020, Adiele participated in a money laundering conspiracy, laundering $2.3 million for online romance fraud scammers into 12 different bank accounts that he controlled.

Adiele used his international car dealing business to conduct financial and wire transactions to individuals in Nigeria.

The conspiracy involved unidentified perpetrators who fabricated online relationships with men and women throughout the United States to manipulate the victims into sending money to one of Adiele’s bank accounts. Many of the victims of the scam were elderly individuals who lost their life savings. In total, Adiele laundered the money from at least 17 victims.

SOURCE

Fraud, government imposter

Plainfield Man Sentenced to almost 4 Years in Federal Prison for $1.5 Million Identity Theft Scheme, Acting as a Mule

Indiana: Man from India gets nearly four years prison; collected victim money sent by FedX in response to calls claiming the victims Social Security Number had been used in a drug crime; took in $1.5 million.

According to court documents, from April 2017 through April 1, 2021, Trivedi defrauded multiple victims, including some elderly individuals, into sending cash to various locations, including Indianapolis via FedEx. Trivedi and his co-conspirators in the U.S. and India masqueraded as federal law enforcement agents and told the victims that their Social Security numbers had been found in connection with criminal activity, often narcotics trafficking. The criminals stated that the victims would be arrested if they did not immediately withdraw large sums of cash and mail it to fictitious individuals.

SOURCE

According to court documents, from April 2017 through April 1, 2021, Trivedi defrauded multiple victims, including some elderly individuals, into sending cash to various locations, including Indianapolis via FedEx. Trivedi and his co-conspirators in the U.S. and India masqueraded as federal law enforcement agents and told the victims that their Social Security numbers had been found in connection with criminal activity, often narcotics trafficking. The criminals stated that the victims would be arrested if they did not immediately withdraw large sums of cash and mail it to fictitious individuals.

SOURCE

Financial Fraud Call Center

Fake call center duping US citizens raided in Hyderabad [India], 115 cyber fraudsters held

Authorities have successfully dismantled a fraudulent international call center in Hyderabad, resulting in the arrest of 115 individuals belonging to an interstate gang.

This group allegedly engaged in scamming US citizens by posing as representatives of a prominent e-commerce company, as reported by the Cyberabad Police on Friday.

Read more

This group allegedly engaged in scamming US citizens by posing as representatives of a prominent e-commerce company, as reported by the Cyberabad Police on Friday.

Read more

08/14/2023

Scammer sentenced to 28 years in prison for taking more than $200K from 68-year-old man with autism.

Image source: Article

Image source: Article

Paul Yonko, 39, was convicted … of engaging in organized criminal activity following a three-day trial. After hearing testimony about Yonko’s criminal past in the punishment phase, jurors handed down a sentence of 28 years.

Yonko, and members of his extended family who all have criminal records as scammers, spent three months in early 2022 fleecing a retired man who has an advanced degree in mathematics. The 68-year-old who has Asperger’s syndrome, which is on the autism spectrum, is socially awkward and thought he had been befriended by a kind family just down on their luck.

READ MORE

Yonko, and members of his extended family who all have criminal records as scammers, spent three months in early 2022 fleecing a retired man who has an advanced degree in mathematics. The 68-year-old who has Asperger’s syndrome, which is on the autism spectrum, is socially awkward and thought he had been befriended by a kind family just down on their luck.

READ MORE

Fake tech support schemer sentenced to 16 years after targeting elderly victims.

The leader in a conspiracy to commit mail fraud has been ordered to federal prison, the United States Department of Justice said.

The DOJ said MD Azad, 26, an Indian national who resided in Houston, pleaded guilty on Aug. 15, 2022, and admitted he participated in a fraud ring from 2019-2020 which operated out of various cities, including Houston.

According to investigators, the ring “tricked and deceived” victims using various ruses and instructed them to send money via wire through a money transmitter business such as Western Union or MoneyGram, by buying gift cards and providing them to the fraudsters or by mailing cash to alias names via FedEx or UPS.

MORE

The DOJ said MD Azad, 26, an Indian national who resided in Houston, pleaded guilty on Aug. 15, 2022, and admitted he participated in a fraud ring from 2019-2020 which operated out of various cities, including Houston.

According to investigators, the ring “tricked and deceived” victims using various ruses and instructed them to send money via wire through a money transmitter business such as Western Union or MoneyGram, by buying gift cards and providing them to the fraudsters or by mailing cash to alias names via FedEx or UPS.

MORE

'Despicable' funeral home scam preys on grieving family members

Lisa Ann Motto with her husband, Doug, on their wedding day. Courtesy Lisa Ann Motto

Lisa Ann Motto with her husband, Doug, on their wedding day. Courtesy Lisa Ann Motto

The day after she lost her husband of 22 years to lung cancer, Lisa received a phone call from a man who said he worked at the funeral home that was handling the cremation.

“He said I needed to make a deposit for insurance purposes, and it was urgent,” recalled Lisa, 58, who lives in Bonita Springs, Florida.

The man told her that she owed $5,000 but that she could pay an initial installment of $2,500. He told her she could use Zelle or Apple Pay to make the payment.

“If there was a Scammers Hall of Shame, this one would make the Top 10 List, without question,” the Federal Trade Commission said in a recent blog post about the funeral home fraud.

READ MORE

“He said I needed to make a deposit for insurance purposes, and it was urgent,” recalled Lisa, 58, who lives in Bonita Springs, Florida.

The man told her that she owed $5,000 but that she could pay an initial installment of $2,500. He told her she could use Zelle or Apple Pay to make the payment.

“If there was a Scammers Hall of Shame, this one would make the Top 10 List, without question,” the Federal Trade Commission said in a recent blog post about the funeral home fraud.

READ MORE

08/12/2023

Fraud Prevention: A Guide for Senior Investors

Image Source: Article

Image Source: Article

Millions of Americans fall victim to financial fraud each year, and elder adults are particularly vulnerable. Below are some of the most common scams, warning signs and tips to prevent you or your loved ones from becoming victims.

The Guide

The Guide

08/11/2023

Nationwide Elder Fraud Scheme

Nationwide fraud scheme ringleader targeting elderly victims sent to prison.

The leader in a conspiracy to commit mail fraud has been ordered to federal prison, announced U.S. Attorney Alamdar S. Hamdani.

MD Azad, 26, an Indian national who illegally resided in Houston, pleaded guilty Aug. 15, 2022, admitting he participated in a fraud ring from 2019-2020 which operated out of various cities including Houston.

U.S. District Judge Kenneth Hoyt has now ordered Azad to serve 188 months in federal prison. Azad, a citizen of India, is expected to face removal proceedings following the prison term. At the hearing, the court heard additional evidence that described Azad as the U.S.-based ringleader working with a call center in India. In handing down the sentence, the court noted the many letters and victim impact statements it had read showing the financial devastation to elderly and vulnerable victims throughout the United States because of this fraud scheme.

“The victims in this case were devastated, financially and otherwise,” said Hamdani. “This fraud ring repeatedly preyed on elderly and vulnerable people in the United States who spoke of threats of bodily harm if they did not comply with demands for more money. Our hope, and that of many of the victims, is deterrence to stop others who would think of doing similar harm in our community and beyond.”

The scheme targeted elderly victims throughout the United States and elsewhere.

The ring tricked and deceived victims using various ruses and instructed them to send money via wire through a money transmitter business such as Western Union or MoneyGram, by buying gift cards and providing to the fraudsters or by mailing cash to alias names via FedEx or UPS.

Part of the scheme involved fraudsters contacting victims by phone or via internet sites for computer technical support and directing victims to a particular phone number. Once victims contacted the fraudsters, they were told various stories such as communicating with an expert that needed remote access to their computer to provide technical support services. The fraudsters then gained access to victims’ personal data and bank and credit card information.

Victims typically paid a fee to conspirators for the fake technical support but were later told they were due a refund. Through paying for “technical support” or through the “refund” process, the ring gained access to the victim’s bank account(s) and credit cards and manipulated the accounts to make it appear the victim was paid too large a refund due to a typographical error. Victims were then instructed to reimburse the ring by various means.

Victims were sometimes re-victimized multiple times and threatened with bodily harm if they did not pay.

Indian citizen Anirudha Kalkote, 26, also pleaded guilty in relation to the conspiracy as did Sumit Kumar Singh, 26, Himanshu Kumar, 26, and MD Hasib, 27, all also Indian nationals who illegally resided in Houston. They are pending sentencing.

All five individuals will remain in custody.

READ ON

The leader in a conspiracy to commit mail fraud has been ordered to federal prison, announced U.S. Attorney Alamdar S. Hamdani.

MD Azad, 26, an Indian national who illegally resided in Houston, pleaded guilty Aug. 15, 2022, admitting he participated in a fraud ring from 2019-2020 which operated out of various cities including Houston.

U.S. District Judge Kenneth Hoyt has now ordered Azad to serve 188 months in federal prison. Azad, a citizen of India, is expected to face removal proceedings following the prison term. At the hearing, the court heard additional evidence that described Azad as the U.S.-based ringleader working with a call center in India. In handing down the sentence, the court noted the many letters and victim impact statements it had read showing the financial devastation to elderly and vulnerable victims throughout the United States because of this fraud scheme.

“The victims in this case were devastated, financially and otherwise,” said Hamdani. “This fraud ring repeatedly preyed on elderly and vulnerable people in the United States who spoke of threats of bodily harm if they did not comply with demands for more money. Our hope, and that of many of the victims, is deterrence to stop others who would think of doing similar harm in our community and beyond.”

The scheme targeted elderly victims throughout the United States and elsewhere.

The ring tricked and deceived victims using various ruses and instructed them to send money via wire through a money transmitter business such as Western Union or MoneyGram, by buying gift cards and providing to the fraudsters or by mailing cash to alias names via FedEx or UPS.

Part of the scheme involved fraudsters contacting victims by phone or via internet sites for computer technical support and directing victims to a particular phone number. Once victims contacted the fraudsters, they were told various stories such as communicating with an expert that needed remote access to their computer to provide technical support services. The fraudsters then gained access to victims’ personal data and bank and credit card information.

Victims typically paid a fee to conspirators for the fake technical support but were later told they were due a refund. Through paying for “technical support” or through the “refund” process, the ring gained access to the victim’s bank account(s) and credit cards and manipulated the accounts to make it appear the victim was paid too large a refund due to a typographical error. Victims were then instructed to reimburse the ring by various means.

Victims were sometimes re-victimized multiple times and threatened with bodily harm if they did not pay.

Indian citizen Anirudha Kalkote, 26, also pleaded guilty in relation to the conspiracy as did Sumit Kumar Singh, 26, Himanshu Kumar, 26, and MD Hasib, 27, all also Indian nationals who illegally resided in Houston. They are pending sentencing.

All five individuals will remain in custody.

READ ON

08/10/2023

Elder Fraud

Image source: Article (Idaho Senior Independent, August 9, 2023)

Image source: Article (Idaho Senior Independent, August 9, 2023)

Two elders each lost almost $80,000. How to avoid becoming the next scam victim.

LOS ANGELES—Neal checked his email one day and saw that he was being charged several hundred dollars for a software subscription he didn’t want.

The 79-year-old Brentwood retiree called the phone number in the email and allowed a stranger to take remote access of his computer to “fix” the problem. Within 24 hours in late January, two wire transfers from Neal’s Los Angeles bank account ended up in Hong Kong, with Neal having been duped into believing the payments were to correct accounting errors and make him whole.

Just like that, he’d lost $79,500, nearly wiping out an account he and his wife had intended as a down payment in a retirement center.

“Makes me ill, just thinking about this,” said Neal, who is kicking himself because he used to work in financial services and should have known better. He later realized the email was from a personal account rather than the software company he thought he was dealing with. Neal told me he was going through a tough time and not thinking clearly when he fell for the scam.

Mrs. K., a retired educator living in the downtown L.A. area, was shopping online for a car several weeks ago when she got reeled in. The scam began with a pop-up alert about a computer virus and instructions to call a number to get the problem resolved.

Over the next three days, thinking she was following instructions from bank fraud investigators and federal agents, Mrs. K. withdrew piles of $100 bills from her bank account, put it in her purse, then stuffed tens of thousands into bitcoin machines at a Highland Park doughnut shop and two nearby locations.

“Talk about stupid,” said Mrs. K., who is 80 and chalked up her misfortune to a desire to do the right thing.

And now she’s out $75,000.

Neal and Mrs. K. asked that [full name not be used] — they’re embarrassed by how easily they were duped and reluctant to share more personal information with anyone.

“I still can’t believe I did this,” Neal said.

“It’s a wonder I didn’t get killed,” said Mrs. K., who pulled wads of $100 bills from her purse at the three Bitcoin deposit machines as strangers watched.

But Neal and Mrs. K. have lots of company, and the scams can be more subtle than what they experienced. Your Social Security number, credit card data, or various forms of personal identification get stolen, and suddenly you’re seeing charges for goods and services you didn’t purchase.

“We’re getting 400-500 calls daily,” said Amy Nofziger, director of victim support at AARP’s Fraud Watch Network.

Theft targeting older adults is “big business,” Nofziger said, with sophisticated domestic and international schemes. Not that it’s any consolation to Neal or Mrs. K., but Nofziger said that in 21 years of fraud investigations, she has encountered “very intelligent and successful” victims, including doctors and lawyers. Crypto crimes like the one Mrs. K. described are common of late, Nofziger added.

The FBI’s Internet Crime Center reported in May that 88,000 victims over the age of 60 lost $3.1 billion in 2022, an 84% increase from the previous year. (Losses to victims of all ages topped $10 billion.) And authorities say much of elder abuse doesn’t get reported, so the actual total could be far greater.

What you should do:

“Disconnect from the internet and shut down your device if you see a pop-up or locked screen,” the FBI advised in a May 10 warning. “Pop-ups are regularly used by perpetrators to spread malicious software. …Be cautious of unsolicited phone calls, mailings, and door-to-door service offers.” …

READ MORE

LOS ANGELES—Neal checked his email one day and saw that he was being charged several hundred dollars for a software subscription he didn’t want.

The 79-year-old Brentwood retiree called the phone number in the email and allowed a stranger to take remote access of his computer to “fix” the problem. Within 24 hours in late January, two wire transfers from Neal’s Los Angeles bank account ended up in Hong Kong, with Neal having been duped into believing the payments were to correct accounting errors and make him whole.

Just like that, he’d lost $79,500, nearly wiping out an account he and his wife had intended as a down payment in a retirement center.

“Makes me ill, just thinking about this,” said Neal, who is kicking himself because he used to work in financial services and should have known better. He later realized the email was from a personal account rather than the software company he thought he was dealing with. Neal told me he was going through a tough time and not thinking clearly when he fell for the scam.

Mrs. K., a retired educator living in the downtown L.A. area, was shopping online for a car several weeks ago when she got reeled in. The scam began with a pop-up alert about a computer virus and instructions to call a number to get the problem resolved.

Over the next three days, thinking she was following instructions from bank fraud investigators and federal agents, Mrs. K. withdrew piles of $100 bills from her bank account, put it in her purse, then stuffed tens of thousands into bitcoin machines at a Highland Park doughnut shop and two nearby locations.

“Talk about stupid,” said Mrs. K., who is 80 and chalked up her misfortune to a desire to do the right thing.

And now she’s out $75,000.

Neal and Mrs. K. asked that [full name not be used] — they’re embarrassed by how easily they were duped and reluctant to share more personal information with anyone.

“I still can’t believe I did this,” Neal said.

“It’s a wonder I didn’t get killed,” said Mrs. K., who pulled wads of $100 bills from her purse at the three Bitcoin deposit machines as strangers watched.

But Neal and Mrs. K. have lots of company, and the scams can be more subtle than what they experienced. Your Social Security number, credit card data, or various forms of personal identification get stolen, and suddenly you’re seeing charges for goods and services you didn’t purchase.

“We’re getting 400-500 calls daily,” said Amy Nofziger, director of victim support at AARP’s Fraud Watch Network.

Theft targeting older adults is “big business,” Nofziger said, with sophisticated domestic and international schemes. Not that it’s any consolation to Neal or Mrs. K., but Nofziger said that in 21 years of fraud investigations, she has encountered “very intelligent and successful” victims, including doctors and lawyers. Crypto crimes like the one Mrs. K. described are common of late, Nofziger added.

The FBI’s Internet Crime Center reported in May that 88,000 victims over the age of 60 lost $3.1 billion in 2022, an 84% increase from the previous year. (Losses to victims of all ages topped $10 billion.) And authorities say much of elder abuse doesn’t get reported, so the actual total could be far greater.

What you should do:

“Disconnect from the internet and shut down your device if you see a pop-up or locked screen,” the FBI advised in a May 10 warning. “Pop-ups are regularly used by perpetrators to spread malicious software. …Be cautious of unsolicited phone calls, mailings, and door-to-door service offers.” …

READ MORE

08/08/2023

Scams

People are losing more money to scammers than ever before. Here’s how to keep yourself safe.

With the help of technology, scammers are tricking Americans out of more money than ever before. But there are steps you can take to keep your money and information safe.

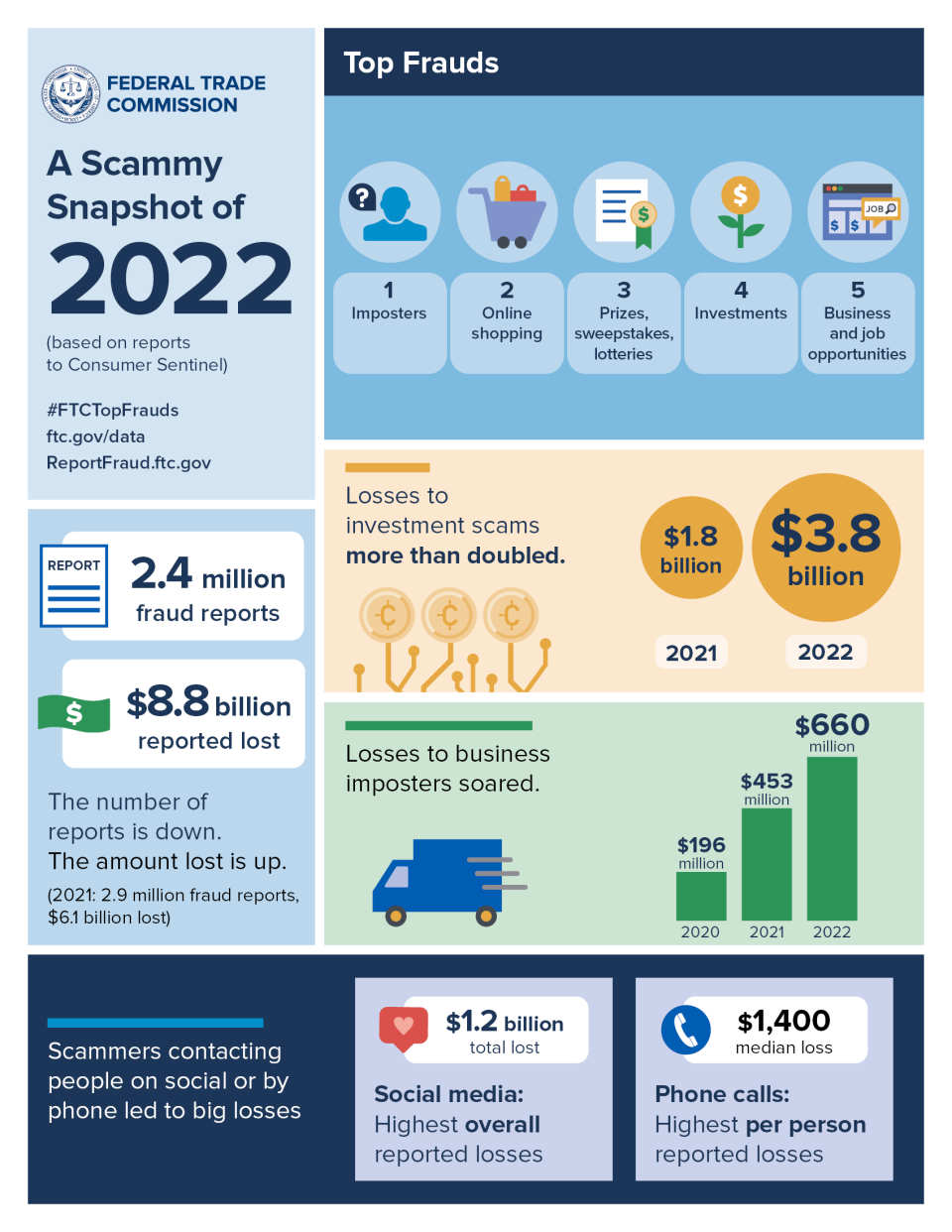

In 2022, reported consumer losses to fraud totaled $8.8 billion — a 30 percent increase from 2021, according to the most recent data from the Federal Trade Commission. The biggest losses were to investment scams, including cryptocurrency schemes, which cost people more than $3.8 billion, double the amount in 2021.

Younger adults ages 20-29 reported losing money more often than older adults ages 70-79, the FTC found. But when older adults did lose money, they lost more. Many retirees have assets like savings, pensions, life insurance policies or property for scammers to target.

“The first thing they’ll do is get you into a heightened emotional state, because we can’t access clear thinking when we’re in that state.”

“When approached with urgency, give it an extra three-second pause.”

READ MORE

With the help of technology, scammers are tricking Americans out of more money than ever before. But there are steps you can take to keep your money and information safe.

In 2022, reported consumer losses to fraud totaled $8.8 billion — a 30 percent increase from 2021, according to the most recent data from the Federal Trade Commission. The biggest losses were to investment scams, including cryptocurrency schemes, which cost people more than $3.8 billion, double the amount in 2021.

Younger adults ages 20-29 reported losing money more often than older adults ages 70-79, the FTC found. But when older adults did lose money, they lost more. Many retirees have assets like savings, pensions, life insurance policies or property for scammers to target.